Gold Investment

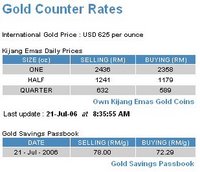

Maybank offers 2 types of gold investment. They are Kijang Emas Gold Coins and Gold Savings Passbook. As can be seen from the daily price quoted beside, the margins between buying and selling price are very different for each type of investments, and sizes (oz). For Kijang Emas Gold Coins, the margins for 1oz, 0.5oz and 0.25oz are 3.31%, 5.26% and 7.30% respectively. For Gold Savings Passbook, its margin is even higher, at a costly 7.90%! I guess this is because Gold Savings allow the smallest trade size (5g), thus it comes with a hefty buying/selling price difference.

Maybank offers 2 types of gold investment. They are Kijang Emas Gold Coins and Gold Savings Passbook. As can be seen from the daily price quoted beside, the margins between buying and selling price are very different for each type of investments, and sizes (oz). For Kijang Emas Gold Coins, the margins for 1oz, 0.5oz and 0.25oz are 3.31%, 5.26% and 7.30% respectively. For Gold Savings Passbook, its margin is even higher, at a costly 7.90%! I guess this is because Gold Savings allow the smallest trade size (5g), thus it comes with a hefty buying/selling price difference.Obviously, the most "economic" choice to invest in Gold is to buy the 1oz Kijang Emas Gold Coins. However, there are few drawbacks which I personally do not like. First, the gold coins is only sold at specific branches, which means inconvinient to trade. Secondly, they are physically gold coin, you have to carry them around during buying or selling, and even have to find a place to save keep them. Gold Savings Passbook is a more convinient way, but the 7.90% margin is hard to swallow. Unless you can forsee that the future gold price will rise >12%, otherwise it is not any better than FD.

I made a chart as below of the price movement of Gold for Y2006 (until 21-July-2006), quoted from www.usagold.com. Hope this gives some hints.....

I made a chart as below of the price movement of Gold for Y2006 (until 21-July-2006), quoted from www.usagold.com. Hope this gives some hints.....

This blog is best viewed with Firefox browser. Download link at side bar.

Labels: Other Investment

0 Comments:

Post a Comment

<< Home