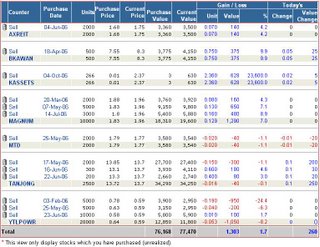

Portfolio 28-July-2006

There was no new trading done this week. My portfolio value has registered a loss of 0.19% (or -RM149) despite KLCI has gained ~1.1%. The main loss is due to the price retreat of Magnum, from RM2.00 to RM1.96, which translates to -RM400. However, I have bigger appetite on Magnum, which I believe that the recent share buy back, disposal of non-core business resulting high pile up of cash indicates something is in cooking....

There was no new trading done this week. My portfolio value has registered a loss of 0.19% (or -RM149) despite KLCI has gained ~1.1%. The main loss is due to the price retreat of Magnum, from RM2.00 to RM1.96, which translates to -RM400. However, I have bigger appetite on Magnum, which I believe that the recent share buy back, disposal of non-core business resulting high pile up of cash indicates something is in cooking....The main gainer of my portfolio for this week is YTLPOWR-w. Although the price increase was just merely 1 sen, with 20 lots I have, this translates to +RM200. To-date, investment in YTLPOWR-w has so far resulting a gross loss of -RM2050, which includes -RM1000 in my past trading (before I set up this blog). I have sold out once 10 lots of YTLPOWR-w at RM0.70 which I acquired at RM0.80. Later, I used this money to buy back the 10 lots at RM0.58, which I believe this counter has reached its bottom.

Looking at the recent development in CPO price, and the gaining fame of palm oil related counters, I hope I'm able to dispose BKAWAN at price >RM9.00. Otherwise, I will keep this counter for long term, as a dividen yielding counter, just like AXREIT.

Overall, the slight drop of my portfolio value doesn't really concern me. And my short term investment strategy in stock still remains the same, that is to continue reduce my share holding. With about RM60,000 cash in hand (from sale of Genting and my other foreign investment recently), I'm searching for an alternative investment vehicle to park this money. I hope I have time to do some research on bond fund and post my findings not too long from now.

This blog is best viewed with Firefox browser. Download link at side bar.

Labels: Portfolio Update

2 Comments:

Good to see that your Bkawan is doing very well, I also have that but my entry level is higher at MYR7.70 and I only bought 200 units. I believe there is potential of this stock. The stock might retreat since last few days the stocks have risen a lot in tandem with performance of other plantation stocks, namely IOI and KLK. For long-term investment, I think better keep this stock.

I'm thinking to keep BKAWAN for long term investment too. However I understand that CPO price is cyclical, and if exceed RM9.00, I'm willing to sell. I do not rule out that I'll buy back later. Currently, there is only 1 stock in my portfolio, which is AXREIT that I intend to keep for long term. It is my first "experiment" to compare long term return of REIT versus others.

Post a Comment

<< Home