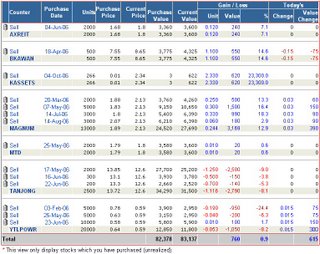

Portfolio 30-Sept-2006

My portfolio almost stayed flat this week, with only slight gain of 0.14%. Compare to KLCI which rose marginally also, 0.24%, it is not that bad afterall.

My portfolio almost stayed flat this week, with only slight gain of 0.14%. Compare to KLCI which rose marginally also, 0.24%, it is not that bad afterall.Magnum regained 3 sen over the week, but unfortunately majority of the gain has been countered off by the drop in Tanjong's share price, from RM12.80 to RM12.60. Tanjong's earning report was disappointing, with net profit dropped 33% from RM117m to RM 78m on QoQ basis. The losses incurred by Germany Tropical Island project have widen to RM17.7m, despite euro 34m (~RM 158m) turn around plan is on way to save this sickening business. Personally, I do not think this leisure business undertaken by Tanjong has any bright prospect, simply because it does not and will not ever meet the expectation of most Europeans for a true tropical vacation. It would have been a huge attraction if it were an artificial snow house for skiing built in Malaysia but it will not be any success that it is a fake beach with unnatural sun-shine in the middle of Europe. Many Europeans do not mind to travel far to real seaside or tropical island to get themselves tanned and enjoy the sea wind, rather than stuck themselves into an imperfect, fake "tropical" dome. The consumerism behaviour of Europeans is totally unlike our Asean, and Tanjong is doomed if it is doing it the Asean way! Nonetheless, I do think the visitor number will go up in the coming next 2 quarters as weather in German is turning cold and into winter but even that, I really doubt the project will turn profitable!

Luckily, this leisure business is only a minor bit of Tanjong and other businesses such as gaming and power are still very stable and generating constant flow of profit. At current price of RM12.60, Tanjong is very attractive to me and I am looking forward to buy in more at price below RM12.50. I do not mind to hold Tanjong for long term as it has reasonable dividend yield (estimated 3-4% in my own calculation), much better than holding YTLPWR-w with zero dividend and bleak prospect of capital gain.

On the other hand, I will start reporting the performance of my other portion of investment, i.e. bond fund. I am still thinking a proper format to keep track of it but until end of this week, I am happy to report that both my PBOND and PIBOND has started generating profit. PBOND is the better performer, which has gained 0.77% while PIBOND gained 0.42%, despite both were purchased at 0.25% premium of its NAV price due to upfront loading. In value, my investment in bond fund has steadily increased to RM50,298.11 in just over 3 weeks. Sweet!

Labels: Portfolio Update

0 Comments:

Post a Comment

<< Home