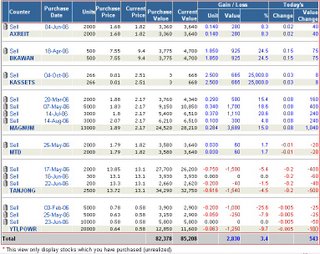

Portfolio 26-Aug-2006

This week, my basket of stock selection finally gave me more impressive gain compare to many previous weeks of boring performance. My portfolio value has inched up by 1.72% (+RM1438) while KLCI only increased by 0.90%.

Main gainer of course has to be Magnum, gaining an impressive 6.89% from last week. As mentioned in the previous post, Magnum quarterly result was indeed impressive and at current price of RM2.14, its PER is only 12.3. This is quite comparable to BJTOTO with PER of 12.5. These numbers are low mainly due to their improved EPS. I am earger to look at the coming balance sheet of BJTOTO and Tanjong to determine if the overall market for gaming sector has expanded. I have a thinking that maybe due to current tougher economic condition, there are more people resort to betting in hope for a sudden windfall...hahaa, what a crazy thinking. My current target price for Magnum is RM2.30, in anticipation for further share buyback and re-valuation of gaming counters. Hopefully, BJTOTO will also show an impressive balance sheet mid next month.

The only disappointment I have in the week is with the ROS announcement by YTL Corp. Although YTL Power has registered a good quarterly result with profit increased by 17.8%, it did not manage to lift up the share price. As I have suspected, the ROS will create more negative impact to YTL Power and its warrants than a good earning can turn it around, I have indeed placed a selling order of half of my stake in YTL Power-w at RM0.61 on Friday morning, but failed to be carried out. At yesterday closing price of RM0.58, I think that the warrants is set at a dangerous level compare to its mother share which has lost 7 sen in a day. Personally, I don't see much capital gain potential on YTL Power-w because of the dragging IPA issue, and its future price when ROS is executed. I believe there must be some amount of profit taking by retail investors after receive their ROS and that definitely will batter the share price. This is simply another case of supply-demand balance. Logic tells me to sell out my stake now but emotionally I hate to cut loss. Although the warrants price has been consistently in downtrend and almost reach to bottom, I suspect in coming few weeks, its price will still go down slightly and then stay a while at RM0.50 - 0.60 range. Hard decision for me, after all, I hate to sell out at bottom trough but on the other hand need to correct my share exposure in short time.... Tough!

Main gainer of course has to be Magnum, gaining an impressive 6.89% from last week. As mentioned in the previous post, Magnum quarterly result was indeed impressive and at current price of RM2.14, its PER is only 12.3. This is quite comparable to BJTOTO with PER of 12.5. These numbers are low mainly due to their improved EPS. I am earger to look at the coming balance sheet of BJTOTO and Tanjong to determine if the overall market for gaming sector has expanded. I have a thinking that maybe due to current tougher economic condition, there are more people resort to betting in hope for a sudden windfall...hahaa, what a crazy thinking. My current target price for Magnum is RM2.30, in anticipation for further share buyback and re-valuation of gaming counters. Hopefully, BJTOTO will also show an impressive balance sheet mid next month.

The only disappointment I have in the week is with the ROS announcement by YTL Corp. Although YTL Power has registered a good quarterly result with profit increased by 17.8%, it did not manage to lift up the share price. As I have suspected, the ROS will create more negative impact to YTL Power and its warrants than a good earning can turn it around, I have indeed placed a selling order of half of my stake in YTL Power-w at RM0.61 on Friday morning, but failed to be carried out. At yesterday closing price of RM0.58, I think that the warrants is set at a dangerous level compare to its mother share which has lost 7 sen in a day. Personally, I don't see much capital gain potential on YTL Power-w because of the dragging IPA issue, and its future price when ROS is executed. I believe there must be some amount of profit taking by retail investors after receive their ROS and that definitely will batter the share price. This is simply another case of supply-demand balance. Logic tells me to sell out my stake now but emotionally I hate to cut loss. Although the warrants price has been consistently in downtrend and almost reach to bottom, I suspect in coming few weeks, its price will still go down slightly and then stay a while at RM0.50 - 0.60 range. Hard decision for me, after all, I hate to sell out at bottom trough but on the other hand need to correct my share exposure in short time.... Tough!

This blog is best viewed with Firefox browser. Download link at side bar.

Labels: Portfolio Update

0 Comments:

Post a Comment

<< Home