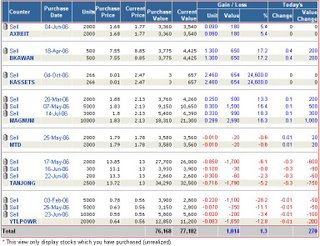

Portfolio 12-Aug-2006

At first, I thought I'll skip my portfolio update this week. However, there are some big price movements in several stocks that I have and decided to do this update as a note for myself.

First, KLCI has inched up by 0.46% last week to 942.27 points. On the other hand, my portfolio has made a terrible loss of 0.69%. I said this is terrible not because of the overall percentage, but particular to few counters that I have, namely Tanjong and YTLPWR-w.

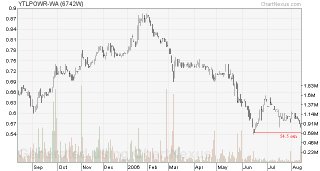

Tanjong has dropped as much as 5.8%, which is about -RM2000 for me, while YTLPWR-w lost 5.1% (-RM600). I have mentioned last week that I think both for both counters, their share prices are already at depressed level. With KLCI at about the same 940 points (during mid-Apr this year), both counters were priced at ~RM14.50 and ~RM0.74 respectively. These were their price before the government allows TNB to revise its power reserve level, which affects IPP. However, both counters dropped even further last week, that raised my alert.

For Tanjong, I did a plot with ChartNexus, and observed that there is a strong resistance/support level at ~RM14.00 base on price history of 1 year. Tanjong has been continuously sold down in last week, and to me the next support level (although a weak one) will be at ~RM12.80. There was no major transaction by shareholder or any new negative news, I was puzzled. Tanjong is a good counter, with diversified business and dividen yield of 5.5 - 6.0% base on current price. Revenue of power plants in Malaysia contributes about 50% of its overall power business, which I think the new negotiation in IPA will only has limited impact to Tanjong. If it is not because I have a pessimistic view on economy for coming 6-12 months, and also my current high weighting on Tanjong, I will not hesitate to accumulate more when it drops further. Now, I think I'll hold onto the Tanjong share I have, and monitor closely on news of Tanjong. I believe Tanjong should fetch a better price than now for me to sell.

As for YTLPWR-w, I am looking forward for its quarterly result to be announced in this month and hopefully its share price can rebound. The price gap between the warrant and mother share has widen a lot, mainly due to active share buyback of its mother share that support its price. I am regret that I did not take Investsmart recommendation earlier to trade off the warrants and buy mother share. I am prepared to cut loss (again!) at slightly higher price to minimize losses.

The main gainer of this week is no doubt Magnum, with ~8.7% price increment. So far, I have made about ~17% return from this counter including the dividen received lately in less than half a year, which I'm quite satisfied. As I mentioned last week, Magnum has continued to buy back its share actively and I believe they will continue this in coming few weeks or months. I'll only consider to sell my stake when the price start to stagnant and retreat.

This blog is best viewed with Firefox browser. Download link at side bar.

For Tanjong, I did a plot with ChartNexus, and observed that there is a strong resistance/support level at ~RM14.00 base on price history of 1 year. Tanjong has been continuously sold down in last week, and to me the next support level (although a weak one) will be at ~RM12.80. There was no major transaction by shareholder or any new negative news, I was puzzled. Tanjong is a good counter, with diversified business and dividen yield of 5.5 - 6.0% base on current price. Revenue of power plants in Malaysia contributes about 50% of its overall power business, which I think the new negotiation in IPA will only has limited impact to Tanjong. If it is not because I have a pessimistic view on economy for coming 6-12 months, and also my current high weighting on Tanjong, I will not hesitate to accumulate more when it drops further. Now, I think I'll hold onto the Tanjong share I have, and monitor closely on news of Tanjong. I believe Tanjong should fetch a better price than now for me to sell.

As for YTLPWR-w, I am looking forward for its quarterly result to be announced in this month and hopefully its share price can rebound. The price gap between the warrant and mother share has widen a lot, mainly due to active share buyback of its mother share that support its price. I am regret that I did not take Investsmart recommendation earlier to trade off the warrants and buy mother share. I am prepared to cut loss (again!) at slightly higher price to minimize losses.

The main gainer of this week is no doubt Magnum, with ~8.7% price increment. So far, I have made about ~17% return from this counter including the dividen received lately in less than half a year, which I'm quite satisfied. As I mentioned last week, Magnum has continued to buy back its share actively and I believe they will continue this in coming few weeks or months. I'll only consider to sell my stake when the price start to stagnant and retreat.

This blog is best viewed with Firefox browser. Download link at side bar.

Labels: Portfolio Update

0 Comments:

Post a Comment

<< Home