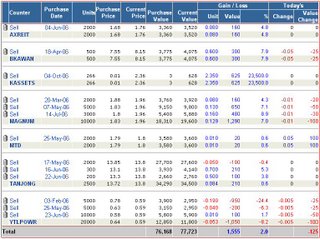

Portfolio 05-Aug-2006

It was another quiet week for me. My portfolio was almost inline with benchmark KLCI (+0.35%), gaining ~0.33% (or +RM253).

It was another quiet week for me. My portfolio was almost inline with benchmark KLCI (+0.35%), gaining ~0.33% (or +RM253).Gainers were Tanjong (+0.07%), AXREIT (+0.57%) and MTD (+1.69%) while loser was BKAWAN (-1.81%). Market has traded side way recently, without major breakout. Some has said that technically, there already appeared an uptrend signal last week and I certainly looking forward for that to reduce my overall stock exposure.

As one can see that my whole portfolio is currently dominated by power related counters such as YTLPOWR-w and Tanjong. These 2 counters alone already contribute ~60% of total portfolio value. Although both counters are not all about power business, but any new development between Tenaga and IPP on the PPA issue will definitely "swing" my portfolio.

I was actually a bit disappointed that this issue has to be dragged to the end of the year. On the other hand, I was also relieved that it seem both parties (to me, most importantly the IPP) are advocating to protect its own interest. It is already expected that the outcome will likely unfavorable to IPP, however I think the current depressed share price already factored in this concern. Any slight improvement on the negotiation that benefits the IPPs will definitely move their share prices higher.

On another note, Magnum has been actively buying back its share starting from 26-July. Until 4-Aug, Magnum has bought back about 5.37 million shares at an average price of RM1.95-1.98. This however only costs Magnum at most RM10.7 million, compares to it cash pile of more than RM700 million, excluding the additional proceeding from recent sale of Sepang land for RM210 million cash. Judging from this, I believe that the share buyback of Magnum will continue to carry on for some times, and it will be inevitable for its share price to rise gradually in tandem with stronger demand.

On another note, Magnum has been actively buying back its share starting from 26-July. Until 4-Aug, Magnum has bought back about 5.37 million shares at an average price of RM1.95-1.98. This however only costs Magnum at most RM10.7 million, compares to it cash pile of more than RM700 million, excluding the additional proceeding from recent sale of Sepang land for RM210 million cash. Judging from this, I believe that the share buyback of Magnum will continue to carry on for some times, and it will be inevitable for its share price to rise gradually in tandem with stronger demand.I will revise the frequency of my portfolio review from weekly to bi-weekly starting this week. As I continue to reduce my activity and exposure on common stock and focus on other more stable investment vehicles, this will enable me to do more researches and write up in that area instead. Unless there is a sharp change of stock market trend, I will not alter my strategy now.

At the mean time, please feel free to comment and leave your view / opinion / suggestion in the below comment section or the chatbox of sidebar. Looking forward to hear from you and happy trading.

This blog is best viewed with Firefox browser. Download link at side bar.

Labels: Portfolio Update

0 Comments:

Post a Comment

<< Home