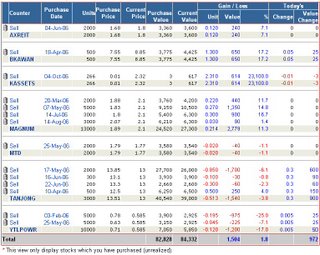

Portfolio 07-Oct-2006

This week, my portfolio value rose 0.90%, outperformed KLCI (+0.35%). Along the week, I have made a switch, converting 10 lots of YTLPWR-w at price RM0.59 to 500 units of Tanjong at price RM12.50.

This week, my portfolio value rose 0.90%, outperformed KLCI (+0.35%). Along the week, I have made a switch, converting 10 lots of YTLPWR-w at price RM0.59 to 500 units of Tanjong at price RM12.50.As mentioned last week, I strongly feel that Tanjong with price below RM12.50 is much better to hold than YTLPWR-w. Besides, referring to The Edge Daily, Tanjong PER is just about 12 and next interim dividend of 12 sen will be due on Oct 18. Its estimated dividend yield of 6.4% (or 80 sen per share) at RM12.50 now is irresistible. This although does not seem to be in line with my overall strategy of cashing out from equity, I bet Tanjong's downside risk is limited and hope that with this cost down, I can achieve a better opportunity to exit later.

Magnum has traded in a narrow band lately, with strong support at RM2.10. There is always the thinking to take profit lingering around in my mind but so far I have been able to suppress that. I still can see occasional share buyback of Magnum and this made me think its current RM2.10 will be well supported. I will only consider to dispose partial of it if it starts to breach RM2.20 again.

This week, my bond fund value increased to RM50399.97 from last week value of RM50298.11, or 0.21% increment w-o-w. PBOND still performed better than PIBOND, with to-date return of 1.03% and 0.57% respectively in a time frame of ~1 month. Frankly, I am very satisfied with these performances, considering the fact that these 2 funds are consistently rising from day to day.

Labels: Portfolio Update, Stock Market

0 Comments:

Post a Comment

<< Home