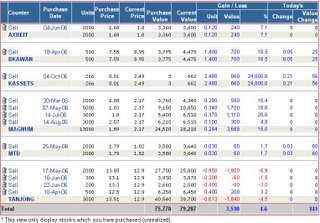

Portfolio 14-Oct-2006

This week, KLCI continues its "mini bull" trend by inching up another 1.29% to 983.54 points, an all time high in nearly 6.5 years. Looking back to my portfolio value compare to last week, it also managed to chunk out a reasonable 2.82% hike, mainly owing to the rise of Magnum.

Magnum has increased 3.3% over the week to RM2.17 due to active share buyback. Technically, I think Magnum is on the bullish trend based on my amateur analysis skill. From the MACD indicator, the bullish centerline crossover has just emerged after a rather weak positive divergence trend. This usually means buy signal. I am crossing my fingers hoping that Magnum will break through its resistance level of RM2.20-2.23 so that I am able to sell out partial of Magnum share at price beyond RM2.50.

Along the week, I also managed to sell out all the remaining YTLPWR-w at price RM0.65. The sudden surge of YTLPWR and its warrant without any positive news posed a great opportunity for me to dispose it totally. From the beginning till now, the whole trading of YTLPWR-w has costed me a loss of RM1450 or -6.96%. I learnt two important lessons from this losing trade. First, never buy any warrant during a stagnant or bearish market. Holding it will not generate any dividend and due to its price leveraging power, losses can be huge. Secondly, never buy a non growth stock at its peak price in a non bullish market. I do not doubt that YTLPWR is a fundamentally strong counter. Unfortunately, I also do not think that it can be considered as a growth stock, that can justifies any consistent price appreciation. The buy-in price of YTLPWR-w for me was as high as RM0.805 in Feb this year and I have to admit this was my big mistake.

On the other hand, my bond fund continues to grow in value. PBOND grows 0.23% while PIBOND grows 0.13%. Total value has increased to RM50,488.79. As of this week, my equity to bond ratio stands at 61:39, still far from my target of 10:90. I have set a dateline until 30th June 2007 to achieve this weighting, in preparation for an economic recession.

Along the week, I also managed to sell out all the remaining YTLPWR-w at price RM0.65. The sudden surge of YTLPWR and its warrant without any positive news posed a great opportunity for me to dispose it totally. From the beginning till now, the whole trading of YTLPWR-w has costed me a loss of RM1450 or -6.96%. I learnt two important lessons from this losing trade. First, never buy any warrant during a stagnant or bearish market. Holding it will not generate any dividend and due to its price leveraging power, losses can be huge. Secondly, never buy a non growth stock at its peak price in a non bullish market. I do not doubt that YTLPWR is a fundamentally strong counter. Unfortunately, I also do not think that it can be considered as a growth stock, that can justifies any consistent price appreciation. The buy-in price of YTLPWR-w for me was as high as RM0.805 in Feb this year and I have to admit this was my big mistake.

On the other hand, my bond fund continues to grow in value. PBOND grows 0.23% while PIBOND grows 0.13%. Total value has increased to RM50,488.79. As of this week, my equity to bond ratio stands at 61:39, still far from my target of 10:90. I have set a dateline until 30th June 2007 to achieve this weighting, in preparation for an economic recession.

Labels: Portfolio Update

1 Comments:

personally i think YTLPOWR is a cash cow... good for retirees that gets their pension to dump in YTLPOWR and harvest the dividends.. can't expect much from capital appreciation.. especially this year..

previously 2001-2005 the stock price was a 45 degrees upwards... this year quite boring.. maybe because of strengthening RM as it depreciates "A BIT" that causes malaysians not to invest in such counter... main income of YTLPOWR is from oversea.. UK n aussie indon mainly

Post a Comment

<< Home