Portfolio 25-Nov-2006

It has been more than a month that I have stopped posting new article. My apologize for that and definitely I am still very much want to keep this blog alive, at least to the time that I am able to achieve my dream, with 1 million net worth...hahaa

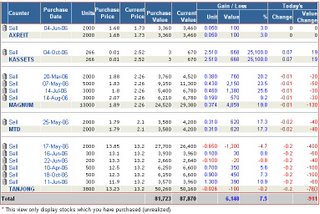

It has been more than a month that I have stopped posting new article. My apologize for that and definitely I am still very much want to keep this blog alive, at least to the time that I am able to achieve my dream, with 1 million net worth...hahaaSince my last blog, KLCI has risen from 983.54 to 1060.43 points (or 7.82%). On the other hand, my portfolio value also gone up from 4.6% to 7.5% net return, despite that I have taken some profits from selling out all my stacks of BKAWAN (1000 units) at RM9.50, with roughly 25% profit. The proceeding of that was used to re-invest into Tanjong, by acquiring additional 500 and 300 units at price RM12.30 and RM11.90 respectively.

Todate, BKAWAN has risen to RM11.10 or 16.84% while Tanjong only gained 8.65% in average from my last 2 purchase prices. I admit this appears as now not a smart move, as I have not anticipated that palm oil stocks still have that much of steam to go up despite the cooling down of crude oil price. However, to me, Tanjong is relatively cheap at its current price level, fetching an undemanding PE of 14x and a dividend yield of 5%. Personally, I bet the earning of Tanjong will be improved. This should be seen in its coming quarterly report in next 2-3 weeks time.

MPHB has announced a general offer for Magnum at RM2.30. The intention of this according to MPHB is take Magnum as its subsidiary and hence streamline its operation. MPHB will still want to maintain the public listing status of Magnum after the exercise. This is rather confusing to me. What MPHB meant is to finally raise its stake from current 39.9% to between 51%-75% and takeover the directive control of Magnum Corp? What is the advantage of doing that? Going after the cash pile of Magnum Corp? Yeap, it can become another example of poor corporate governance by scarifying the benefits of retail investors, really disappointed with the management.

Hopefully, this move by MPHB will not be successful. I will now hold on my share of Magnum until the last day of the GO, and praying that MPHB will not achieve the 50+1 percent of shareholding to initiate a conditional GO. MPHB got the pay a higher premium for it to own this golden cow of Magnum and the retail investors like me got to be rewarded appropriately!

Labels: Portfolio Update