First, my

apologise to all my blog readers as I did not manage to do the portfolio review for last week in time. The reason is I did not manage to capture the price change of my portfolio as I am on traveling. I'm too lazy now to track back (without able to refer directly from my Star portfolio) as I believe that the minor change in my portfolio is not worth to mention. However, I would like to mark down here few of my comments in view of the budget 2007 announcement and some corporate developments concerning my portfolio that happened last week.

I was delighted that government has finally reduced the tax imposed on REIT, despite it is only a mere 8% reduction (to 20%) in the case for foreign investor. If I interpret correctly, for Malaysian, the REIT tax will be capped at 15% instead of 28%, which follows individual income tax bracket. This means tax will be lesser for people with annual taxable income of more than RM50k. This will certainly make REIT more attractive in term of nett yield. Nonetheless, compare to Singapore with only 10% tax for

foreign investor, there is still a big gap to catch up with. This is reflected in the share prices of

REITs after budget announcement, which did not get boosted at all. I think it is just a matter of time for

foreign investor to come and start investing in local REIT, as encouraged by the positive move of government and most importantly, the potential appreciation of RM. In addition, I also feel that the new tax structure which will only apply to REIT that distributes at least 90% of their income is another positive action to encourage more

REITs to comply to this requirement. So for those

richies out there, make sure you buy some good

REITs (with 6-8% yield) and start enjoying the lower tax of 15% on your side income!

The second goodness is of course the corporate tax reduction from 28% to 27% in 2007 and eventually 26% in 2008. In an article from

The Edge Daily, the saving in tax reduction can almost

wholly be transferred to the same increase in earning (0.9% according to one analyst base on their share selection). Personally, I doubt this eventually will make any big "wave" to the general industry. Moving forward, many has acknowledged that the economy will be slowed down, thus reduced earning or even potential loss may happen to the corporate. The 1% saving in tax (in the case of corporate makes profit) will only give an additional boost in good time but during the bad time, its effect is near minimal if not none, in my opinion. Government got to take other more aggressive measures to reduce the bottom line of cost of doing business, such as direct monetary incentive to certain industries or sectors that are most vulnerable to economy slowdown. Thus, I will not rejoice over this move by government, and certainly will not alter my stance of continuing reduce my exposure in stock market.

Lastly, this is a note to myself. For those who follows my blog, you will notice that I have never or seldom touch on the discussion of some counters in my portfolio, likes

MTD or

KASSETS. The reason is because I treat these counters as

hibernating counters which I do not have any plan to buy or sell them in short term. As time passes and new development progresses, in this case is

MTD, I revise my call. The latest quarterly report of

MTD is indeed very

disappointing to me. Mainly I see that its quarterly profit has dropped ~44% and debt has widen by ~14% compare to the last quarter.

Investsmart has done a review and he has downgraded it from BUY to HOLD. For me, I will be looking

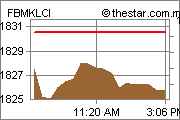

forward to sell this counter when it touches RM1.83, where I'm able to

recoup some of the transaction and

opportunity cost involved.

At last, I made a real change in my investment vehicle weighting today. I have dropped the idea to invest in gold in the last minute and bought more bond fund instead. If you are interested to know the reasons of my last minute change and details of my latest move, watch out for my next post.....

Finally, I did pull up myself and do the portfolio review this week. I was busy on some other works for the past few weeks, which include developing my new found hobby...photography @ velo photo, heheee...

Finally, I did pull up myself and do the portfolio review this week. I was busy on some other works for the past few weeks, which include developing my new found hobby...photography @ velo photo, heheee...