Trade: Magnum & Tanjong

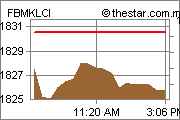

Yesterday, I made a major move by selling all my 13000 units of Magnum share at RM3.30 and the remaining 1000 units of Tanjong at RM15.90. The main reason that I did the sell-off was I am getting worried with the U.S. economy development and I believe the whole global market will be dragged down by it, regardless it will be a soft or hard landing. The fact that many Americans are spending way beyond than what they made and tougher credit facilities to fuel the consumer purchase which triggered by softening of housing market is undebatable. Besides, many local analysts although did upward revise their target KLCI index from 1300 to 1400 by year end, but to me it is not a big margin from what we are today and the risk of going down has out striped the potential of thin gain anticipated.

If I look at the earning of Magnum which is about 16 sen per share, at RM3.30, PE is ~20.5. Compare to BJTOTO with 36 sen per share earning, PE at RM4.40 is only ~12.2. This is way too high for Magnum. Even if we factor in a potential capital return of RM1.00, PE of Magnum at RM2.30 is still ~14.4. I have long never did such a PE calculation on Magnum and was surprised with the figure. Hence, I reckon it is now a good time for me to sell off the share, and keep a close eye on it. Hopefully I can pick it up later when it drops below RM2.80.

Below is my latest share portfolio after yesterday trading.

If I look at the earning of Magnum which is about 16 sen per share, at RM3.30, PE is ~20.5. Compare to BJTOTO with 36 sen per share earning, PE at RM4.40 is only ~12.2. This is way too high for Magnum. Even if we factor in a potential capital return of RM1.00, PE of Magnum at RM2.30 is still ~14.4. I have long never did such a PE calculation on Magnum and was surprised with the figure. Hence, I reckon it is now a good time for me to sell off the share, and keep a close eye on it. Hopefully I can pick it up later when it drops below RM2.80.

Below is my latest share portfolio after yesterday trading.

Labels: Stock Market