Portfolio 27-Jan-2007

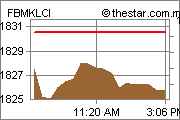

Despite KLCI continues to inch up 1.93% to 1169.89 points this week, my portfolio has grown 9.3% (or RM10,480), beating KLCI by a huge margin! In my memory, this is my most impressive gain in a week.

REIT has risen a lot since last week. AXREIT jumped from the lowest RM1.62 to now all time high of RM1.85, gaining ~14% in just one week. Similarly, STAREIT also managed to chunk out a weekly gain of ~12%. The sharp increase in REIT price in my opinion is driven by active foreign participation, as can been seen by the supported trading volume. As predicted, with the strengthening trend of RM, all the MREIT prices are due to be revised by market.

However, my view for its coming few weeks is most MREITs will rise to a saturated point and maintain until there are further good news from the government. Also, even though the government said they are comfortable with current RM exchange rate, I doubt they will let it continue to rise beyond RM3.40. If both AXREIT and STAREIT managed to hit near RM2.00 and RM1.00 respectively, I am willing to let go all my stake of it. They are no longer appeal to me from the yielding perspective and to lock-in the profit now is a much wiser move.

Another strong mover in my portfolio this week is Magnum. My stance on Magnum has not changed, I will hold on Magnum until the end of this bull market or until the much anticipated capital return being announced. Since my entry price of Magnum is relatively low, I am willing to take this bet.

Along the week, I have also added 1000 units Tenaga @ RM12.30 into my portfolio. For me, this is purely a speculative move. According to OSK, the PER for FY07 at current price is ~20.5, with estimated EPS of 59 sen. To me, this is ridiculously high and from fundamental point of view, I rather dump my money into Tanjong than Tenaga. However, Tenaga is a much more active counter than Tanjong and given the latest impressive earning report in such a bullish market, I am quite confident Tenaga will continue to rise in tandem with market. This is sort of my "hit n run" strategy for the time being.

REIT has risen a lot since last week. AXREIT jumped from the lowest RM1.62 to now all time high of RM1.85, gaining ~14% in just one week. Similarly, STAREIT also managed to chunk out a weekly gain of ~12%. The sharp increase in REIT price in my opinion is driven by active foreign participation, as can been seen by the supported trading volume. As predicted, with the strengthening trend of RM, all the MREIT prices are due to be revised by market.

However, my view for its coming few weeks is most MREITs will rise to a saturated point and maintain until there are further good news from the government. Also, even though the government said they are comfortable with current RM exchange rate, I doubt they will let it continue to rise beyond RM3.40. If both AXREIT and STAREIT managed to hit near RM2.00 and RM1.00 respectively, I am willing to let go all my stake of it. They are no longer appeal to me from the yielding perspective and to lock-in the profit now is a much wiser move.

Another strong mover in my portfolio this week is Magnum. My stance on Magnum has not changed, I will hold on Magnum until the end of this bull market or until the much anticipated capital return being announced. Since my entry price of Magnum is relatively low, I am willing to take this bet.

Along the week, I have also added 1000 units Tenaga @ RM12.30 into my portfolio. For me, this is purely a speculative move. According to OSK, the PER for FY07 at current price is ~20.5, with estimated EPS of 59 sen. To me, this is ridiculously high and from fundamental point of view, I rather dump my money into Tanjong than Tenaga. However, Tenaga is a much more active counter than Tanjong and given the latest impressive earning report in such a bullish market, I am quite confident Tenaga will continue to rise in tandem with market. This is sort of my "hit n run" strategy for the time being.

Labels: Portfolio Update