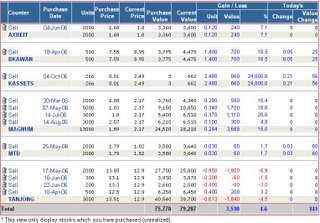

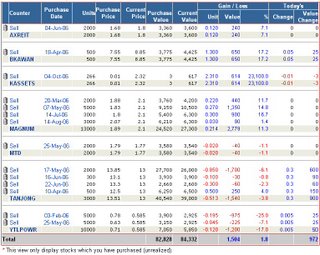

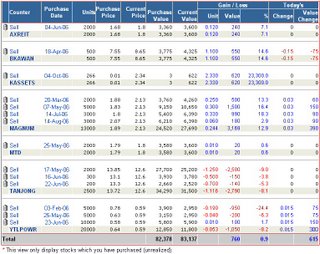

Portfolio 14-Oct-2006

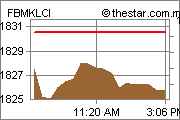

This week, KLCI continues its "mini bull" trend by inching up another 1.29% to 983.54 points, an all time high in nearly 6.5 years. Looking back to my portfolio value compare to last week, it also managed to chunk out a reasonable 2.82% hike, mainly owing to the rise of Magnum.

Magnum has increased 3.3% over the week to RM2.17 due to active share buyback. Technically, I think Magnum is on the bullish trend based on my amateur analysis skill. From the MACD indicator, the bullish centerline crossover has just emerged after a rather weak positive divergence trend. This usually means buy signal. I am crossing my fingers hoping that Magnum will break through its resistance level of RM2.20-2.23 so that I am able to sell out partial of Magnum share at price beyond RM2.50.

Along the week, I also managed to sell out all the remaining YTLPWR-w at price RM0.65. The sudden surge of YTLPWR and its warrant without any positive news posed a great opportunity for me to dispose it totally. From the beginning till now, the whole trading of YTLPWR-w has costed me a loss of RM1450 or -6.96%. I learnt two important lessons from this losing trade. First, never buy any warrant during a stagnant or bearish market. Holding it will not generate any dividend and due to its price leveraging power, losses can be huge. Secondly, never buy a non growth stock at its peak price in a non bullish market. I do not doubt that YTLPWR is a fundamentally strong counter. Unfortunately, I also do not think that it can be considered as a growth stock, that can justifies any consistent price appreciation. The buy-in price of YTLPWR-w for me was as high as RM0.805 in Feb this year and I have to admit this was my big mistake.

On the other hand, my bond fund continues to grow in value. PBOND grows 0.23% while PIBOND grows 0.13%. Total value has increased to RM50,488.79. As of this week, my equity to bond ratio stands at 61:39, still far from my target of 10:90. I have set a dateline until 30th June 2007 to achieve this weighting, in preparation for an economic recession.

Along the week, I also managed to sell out all the remaining YTLPWR-w at price RM0.65. The sudden surge of YTLPWR and its warrant without any positive news posed a great opportunity for me to dispose it totally. From the beginning till now, the whole trading of YTLPWR-w has costed me a loss of RM1450 or -6.96%. I learnt two important lessons from this losing trade. First, never buy any warrant during a stagnant or bearish market. Holding it will not generate any dividend and due to its price leveraging power, losses can be huge. Secondly, never buy a non growth stock at its peak price in a non bullish market. I do not doubt that YTLPWR is a fundamentally strong counter. Unfortunately, I also do not think that it can be considered as a growth stock, that can justifies any consistent price appreciation. The buy-in price of YTLPWR-w for me was as high as RM0.805 in Feb this year and I have to admit this was my big mistake.

On the other hand, my bond fund continues to grow in value. PBOND grows 0.23% while PIBOND grows 0.13%. Total value has increased to RM50,488.79. As of this week, my equity to bond ratio stands at 61:39, still far from my target of 10:90. I have set a dateline until 30th June 2007 to achieve this weighting, in preparation for an economic recession.

Labels: Portfolio Update